Dental insurance is a way to avoid the high costs of unexpected dental emergencies and to cover routine dental visits. According to the National Association of Dental Plans, about 77 percent of Americans in 2016 had dental insurance.

If that many people are insured, then dental insurance must be a good investment, right? The answer is: maybe.

Let’s take a realistic look at dental insurance by examining the costs and coverage to determine if it’s right for you.

What Does The Insurance Cover

First, let’s clarify that dental insurance and health insurance are not one and the same. Health insurance covers your bills after you reach your deductible while dental insurance covers your expenses until you reach an annual limit—after which you pay out of pocket.

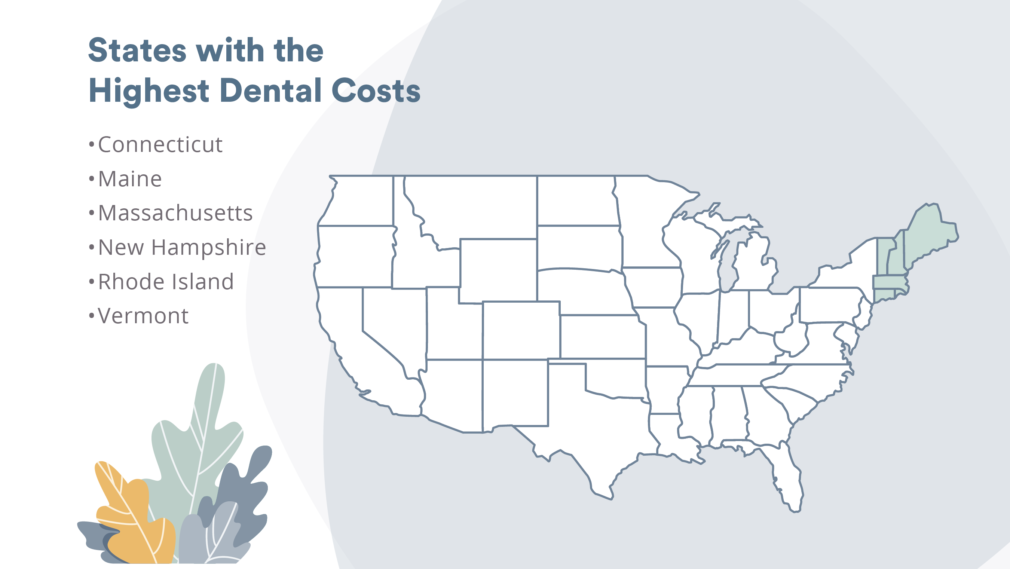

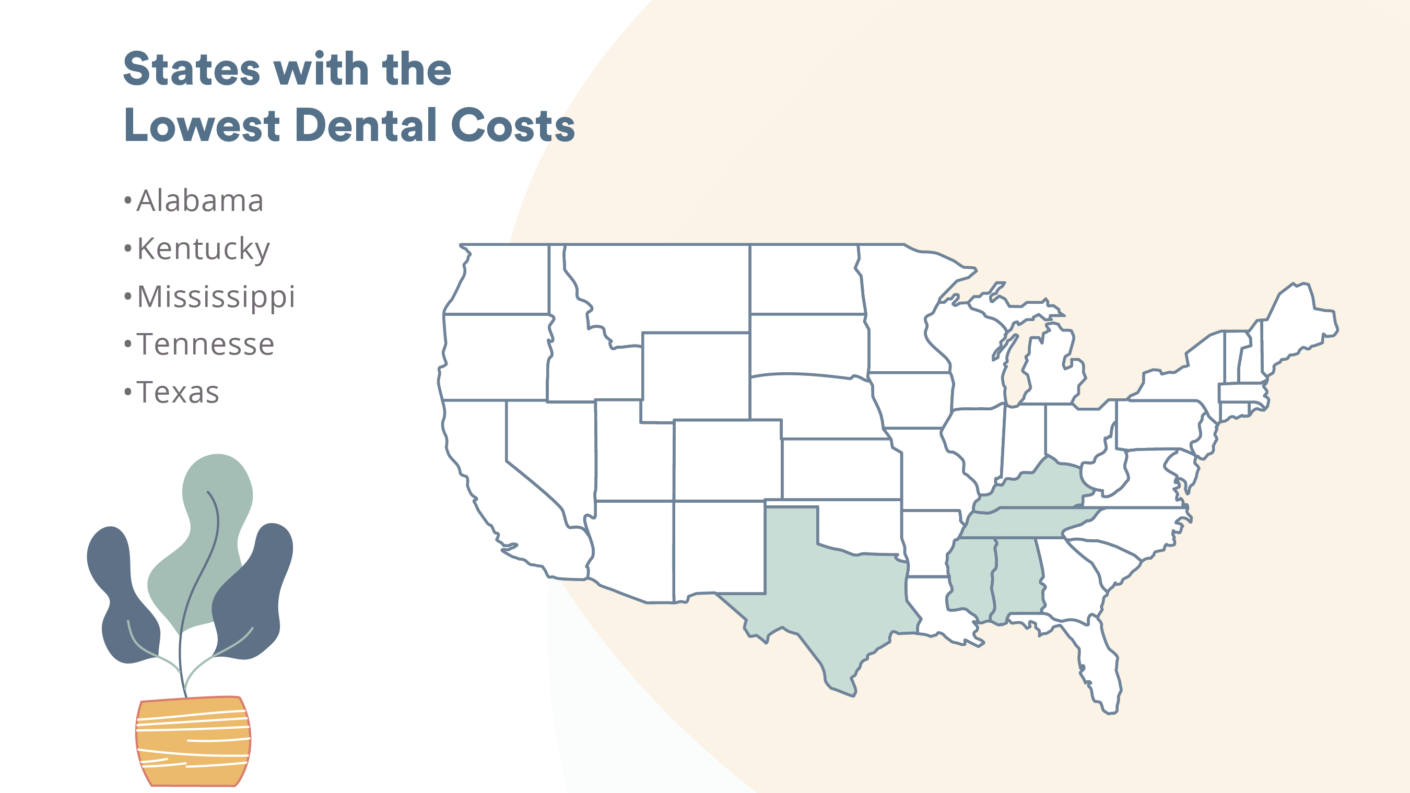

Americans pay about $360 a year on average for dental insurance, which can range between $15 – $50 per month. How much a person pays depends on the plan they have, what state they live in, and how much they pay in premiums. High premiums mean more coverage and low premiums mean less is covered, and the majority of plans come with a coverage limit that most people don’t exhaust.

Your dental insurance is split into three categories: preventative, basic, and major.

The divide is usually in a 100/80/50 structure. Most dental plans cover 100 percent of your preventative care; such as semiannual teeth cleanings, x-rays, oral evaluations, and sealants for some age groups. Insurers typically cover about 80 percent of basic procedures such as cavity fillings, periodontal work, tooth extractions, and fillings. For major procedures, you can expect your dental insurance to pay for about 50 percent. This category includes implants, crowns, bridgework, major oral surgery, dentures, and more.

Cosmetic work like teeth whitening, veneers, tooth shaping, and gum contouring is unlikely to be covered by dental insurance and you will have to pay out of pocket.

It’s also important to note that there are variations in plans. For instance, one insurance plan might consider a root canal to be a basic procedure, while another may rule it to be a major one. For individual policies, it’s standard to have a one-year waiting period before your plan kicks in to cover orthodontics (braces), prosthodontics (dentures or bridges), and periodontics (scaling or root planning).

Types of Dental Insurance

There are several types of dental insurance you can choose from like the ones listed below.

Preferred Provider Organization (PPO)

When you use a PPO, you pay reduced fees to visit “preferred” in-network providers. You aren’t required to use in-network providers, but it will save you money.

The good news is that the insurance network will pay more than an HMO (Health Maintenance Organization) plan or indemnity plan. However, you’ll end up paying more if you use a provider who’s not within the network. Additionally, dental PPOs often have a maximum amount they’ll reimburse you each calendar year.

Just half of PPOs cover over $1,500 each year and the other half only offer benefits below $1,500. Premiums tend to be between $168.72 to $366.84 per year, and family plans are roughly double. Some procedures might have a waiting period before coverage begins.

This type of plan might be useful if you don’t need immediate dental care and want low premiums.

Due for a checkup?

Find a top rated dentist near you that takes your insurance.

Health Maintenance Organization (HMO)

Unlike a PPO where seeing in-network providers is just “preferred,” when you use an HMO, you’re required to use only the dental providers in the insurance network.

While that means you get a minimal choice in providers, with an HMO preventative work is typically completely covered and you might not even have a deductible or maximum annual limit. Premium payments are also on the lower end. You may, however, have a co-pay for basic procedures. An HMO might cover under 50 percent of the costs of major or restorative procedures or leave payment totally up to you.

This type of plan is ideal for people who don’t need a lot of options when it comes to dental providers, have good dental health, and want to focus on preventative care.

Indemnity or Fee-for-Service Plans

With indemnity dental insurance, you choose your dental provider and your plan will pay a percentage of the provider’s fee.

Your deductible might be lower than with other plans and your annual maximum coverage limit might be higher. The downside is that your premiums tend to be higher than other plans and you pay your share of costs upfront.

If you anticipate needing significant procedures and want to have the ability to pick from a large selection of providers, this is the type of plan that will allow you to do so.

Out of Pocket (No Dental Insurance)

Instead of using any dental insurance, you can choose to pay all of your dental care out of pocket.

Prices vary depending on where you live. If your area has a high cost of living, you’ll pay more. The American Dental Association (ADA) conducts surveys every few years to find the average American costs for various dental procedures. According to their 2013 survey (the most recent publicly released data), you can expect to pay around these prices for the following procedures:

- Series of x-rays = $124

- Teeth cleaning = $85

- Silver dental filling = $125

- White dental filling = $149

- Porcelain crown = $1,000

2016 data provided to NerdWallet by FAIR Health shows the average national prices for three types of root canal procedures:

- Front tooth = $762

- Bicuspid = $879

- Molar = $1,111

If you don’t foresee needing dental care often and don’t like the concept of paying a yearly fee for something you may not use, you’re better off paying out of pocket.

Due for a checkup?

Find a top rated dentist near you that takes your insurance.

When Dental Insurance Might be Worth It

For some people, dental insurance is a good investment.

For instance, dental issues aren’t entirely a result of lifestyle choices—they also have strong hereditary influences. If your family has a history of root canals, a high number of cavities, or other dental problems, there is a good chance you’ll also end up needing a lot of dental work. This means you would have frequent dental bills from more regular treatments. In this scenario, you could make the most of your dental insurance.

Another situation where dental insurance makes sense is if you have little to no money set aside for emergencies. When you have no wiggle room in your finances, a major dental procedure can set you back financially. . Rather than choosing between long-term debt and severe dental issues, it’s better to have dental insurance at the ready. Dental insurance can also be motivational. If you need an incentive to stay on top of your dental cleanings and other preventive care, dental insurance might be beneficial to you. It’s standard for dental insurance to cover two annual cleanings. If you don’t use them, you’re missing out on services you already paid for.

When Dental Insurance Might Not be Worth It

Many people find they end up losing money with dental insurance rather than saving any.

For instance, if you have healthy teeth and no unusual dental needs, annual dental insurance may not be useful for you. Except in the case of an emergency, you’ll be paying money into a plan that you almost never use.

Additionally, extra dental insurance outside of what’s offered by your employer is typically unnecessary. Employer dental benefits typically cover between 25 to 80 percent of normal treatment costs like cleanings, crowns, and fillings. In fact, those with great dental health may be better off skipping dental insurance offered by their employer altogether. To determine if your job’s dental insurance is worth it, look over the monthly payments, annual maximum, and coinsurance.

Signing up for dental insurance when you already need an urgent dental procedure is also often useless. There is typically a delay before dental insurance benefits kick in. For major procedures, you may have to wait a full year before your insurance would help with costs. This delay means you either have to pay completely out of pocket for your procedure (while paying for dental insurance that isn’t helping with the procedure) or wait a significant amount of time to get your work done. If you wait too long on a crucial dental issue, you can cause more oral health problems that will be pricey later.

Finally, dental insurance isn’t worth it if there is a specific dentist you want to visit who doesn’t accept dental insurance. Unlike health insurance, dental insurance is not accepted at all practices. Call your dental provider and ask if they accept dental insurance. You don’t want to enroll just to find out you can’t use your new insurance with your preferred provider.

How to Save Money on Dental Work

Even without insurance, there are ways you can save money on the dental work you get done.

One option is to visit a dental school where students conduct procedures while supervised by trained dentists. You pay a lower cost for appointments. The American Student Dental Association (ASDA) has 66 dental schools across the United States and Puerto Rico. Appointments at a dental school are often in high demand, so make sure to book your appointment in advance.

Try visiting a dental clinic. Clinics often offer a fee that’s based on your income and circumstances. . Check for low-cost care options in your state. Even if a clinic says they allow walk-in appointments, call ahead as you may need to put your name on a waiting list. Some people use dental discount plans. These are different from insurance and you can’t use a dental discount plan if you have insurance. A dental discount plan is similar to being a member of a club. You pay an annual fee and sometimes an enrollment fee and in exchange you get a discount on average dental care prices. These fees are usually lower than the costs of premiums on dental insurance policies, but you’ll pay more at the dentist’s office than you would with insurance. There are no waiting periods or annual caps. If you’re an AARP member or part of a similar organization, check to see if you’re eligible for group dental insurance plans offered by your membership.

Is Dental Insurance Worth It?

Whether dental insurance is worth it for you all comes down to personal preference and a combination of factors.

If you have a family history of dental issues, are living on a tight budget, or need motivation to get your preventative dental work done; you may want to look into your options for dental insurance. There are several types of dental insurance available including PPOs, HMOs, and fee-for-service plans. For people with very healthy teeth, employer-offered dental benefits, specific dentists they want to see who don’t accept insurance, or who already need urgent dental procedures done; dental insurance might be a waste of money. Without insurance, you can save money on dental work by using a dental school, dental clinic, or signing up for dental discount plans.